Total taxes taken out of paycheck

Payroll taxes that you collect and remit. 672 More From GOBankingRates.

Paycheck Calculator Online For Per Pay Period Create W 4

The phrase gives three examples of the unalienable rights which the Declaration says have been given to all humans by their Creator and which governments are created to protect.

. Any additional variable debt payments should as well. Total income taxes paid. The COVID-19 related credit for qualified sick and family leave wages is limited to leave taken after March 31 2020 and before October 1 2021.

Claiming more allowances reduces the amount of tax taken out. Claiming fewer allowances increases tax withholding. If you had no tax liability last year and no anticipated tax liability this year then you may be eligible to claim exempt on your W-4 and have no federal tax taken out of your paycheck.

How Much Money Gets Taken Out of Your Paycheck. And B by adding at the end the following. The money you contribute to a 401k plan will be deducted before taxes are taken out.

One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes. There may also be contributions toward insurance coverage retirement funds and other optional contributions all of which can lower your final paycheck.

State and local taxes. The employers portion of both taxes is deductible on your Federal income tax return which can help to offset the sting of paying both parts of the Social Security and Medicare taxes. That works out to 800 per week 3200 per month and 41600 per year--pretax.

Find out if you need to withhold and pay federal taxes. In the United States wealth is highly concentrated in relatively few hands. Form 1040 to your Form 1040 1040-SR 1040-NR 1040-SS or 1041.

Other factors that can affect the size of your paycheck in California or in any other state. However most states have a 54 credit meaning most employers only pay 06. Estate or gift taxes apply to me my estate or an estate for which I am an executor trustee or representative.

Lets say you got a new job that pays 20hour. Like the other principles in the Declaration of Independence this phrase is. Resident status taken away.

For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay. Find out if you need to withhold and pay state taxes. Joe Manchin and Chuck Schumer craft a scaled-back version of the economic package thwarted by Manchin last year.

For example you can have an extra 25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. The total amount is 60. 215 Amount taken out of an average biweekly paycheck.

Life Liberty and the pursuit of Happiness is a well-known phrase in the United States Declaration of Independence. This includes federal income taxes which the IRS puts toward your annual income taxes and FICA taxes which fund Social Security and Medicare. Retirees can use this online calculator to estimate their total income deductions and tax credits for 2018.

636a is amended-- 1 in paragraph 2-- A in subparagraph A in the matter preceding clause i by striking and E and inserting E and F. The amount of federal taxes taken out depends on the information you provided on your W-4 form. Taxes taken out of paycheck is not the same for every employee.

As of 2013 the top 1 of households the upper class owned 367 of all privately held wealth and the next 19 the managerial professional and small business stratum had 522 which means that just 20 of the people owned a remarkable 89 leaving only 11 of the. They also show your net pay the amount of your check after all withholdings. Your employer may make additional voluntary deductions from your paycheck for other reasons.

Remember that whenever you start a new job or want to make changes youll need to fill out a new W-4. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. Both employee and employer shares in paying these taxes each paying 765.

This is part of the Paycheck Checkup campaign to encourage people to check their tax situation as soon as possible. Coral Gables woman out more than 3000 after scammers trick her using Zelle Laura Hernandez says this all started when she received a text message from scammers. Apply what youve learned by putting yourself in the shoes of 20 different taxpayers while you explore the ins and outs of filing tax returns electronically.

Because the total for the 3-year period is 180 days you are not considered a. Use Schedule H. For example if your employer has a 401k plan and you utilize it your contributions will come directly out of your paycheck.

Check your paystub and use a W-4 Calculator to find out if you need to make any changes to your federal. Now its reality taxes. The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes.

This lowers your taxable income and could be a good way for you to save on your taxes until retirement. Dems propose raising taxes on high earners to preserve Medicare Sens. All paycheck stubs show your gross pay the total amount you earned before any taxes were withheld for the pay period.

How Your Indiana Paycheck Works. Well cover each of these in detail beginning with federal income tax withholding. For Delaware residents it also includes state income taxes as well as local taxes for people who live or work in Wilmington.

F Participation in the paycheck protection program--In an agreement. Fiscal year revenues to date were also up 17 compared to FY2019 448 billion partly a result of increased workers wages and salaries particularly among higher-income individuals who pay the majority of federal income taxes. Total spending in June was 623 billion a 482 billion drop compared to June 2020.

However in the event that you will owe taxes claiming exemptions on your W-4 could result in an increased tax burden during filing season. It may also include money for dinners out at restaurants or shopping for items you dont need. That retirement money we added back to your paycheck earlier goes into this category too.

Lawrence Red OwlSimulation 1. When you get paid your employer takes out income taxes from your paycheck. For self-employed individuals they have to pay the full percentage themselves.

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. A In General--Section 7a of the Small Business Act 15 USC. Total income taxes paid.

2813 Amount taken out of an average biweekly paycheck. This paycheck calculator will help you determine how much your additional withholding should be. Well cover both of these in more detail later on.

More Information on Paycheck Taxes. Find out whether or not you can opt out of paying Social Security taxes which are typically taken automatically from your paycheck. The total for this category should not exceed 30.

The last 20 goes toward savings and debt payments. These can include.

Paycheck Calculator Take Home Pay Calculator

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Different Types Of Payroll Deductions Gusto

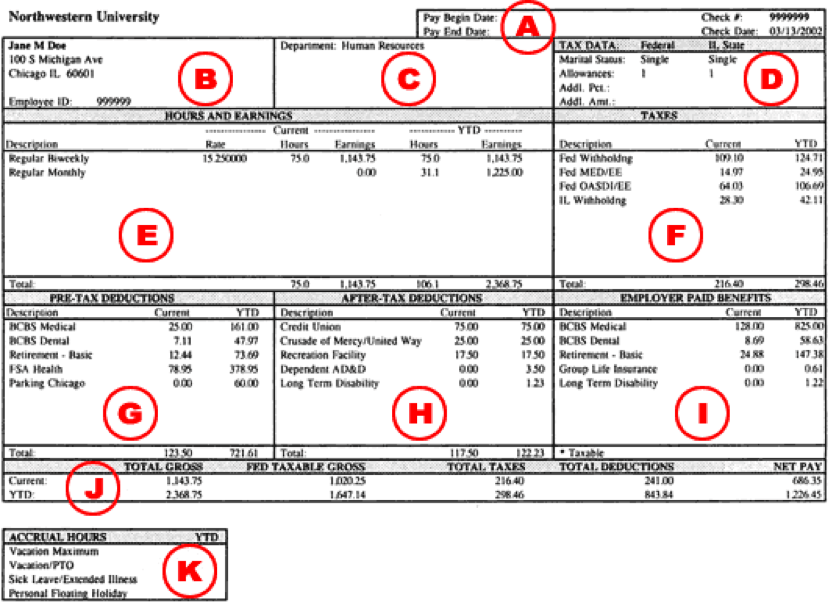

Understanding Your Paycheck Human Resources Northwestern University

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

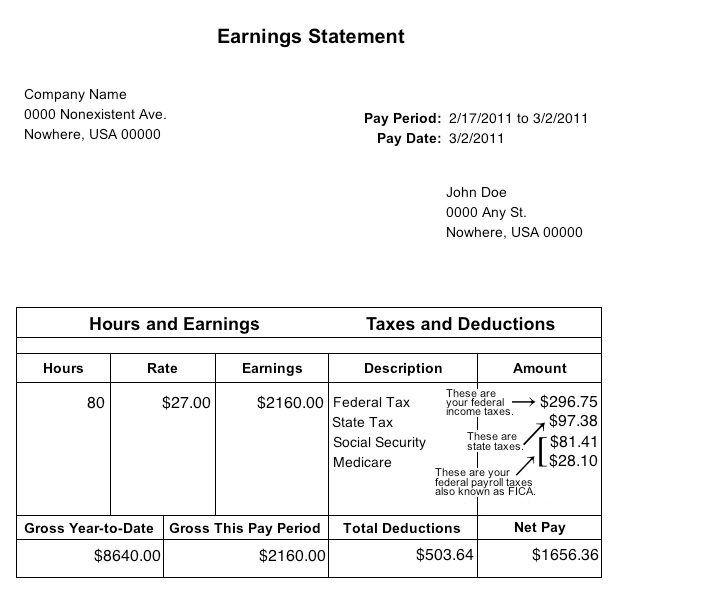

Understanding Your Paycheck

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hrpaych Yeartodate Payroll Services Washington State University

Taxes On Paycheck Deals 51 Off Www Ingeniovirtual Com

Paycheck Calculator Take Home Pay Calculator

Paycheck Taxes Federal State Local Withholding H R Block

Irs New Tax Withholding Tables

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com